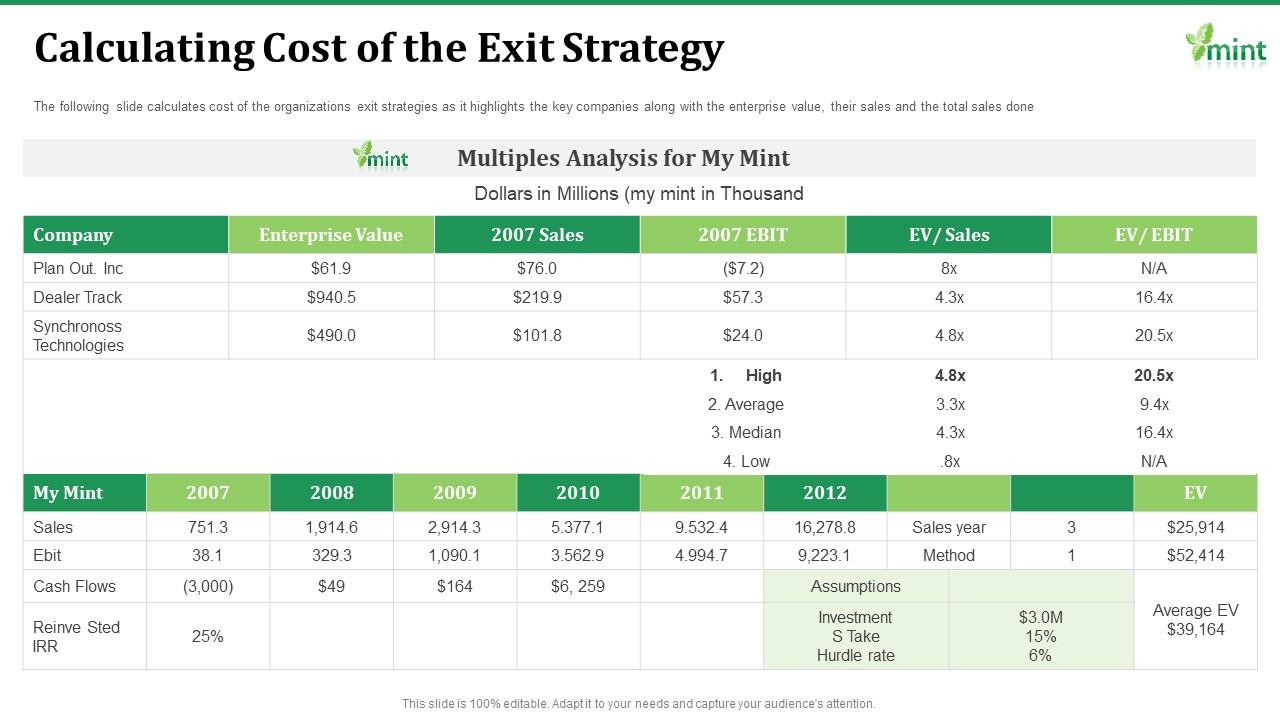

Calculating Cost Of The Exit Strategy Mint Investor Funding Elevator Ppt Information | Presentation Graphics | Presentation PowerPoint Example | Slide Templates

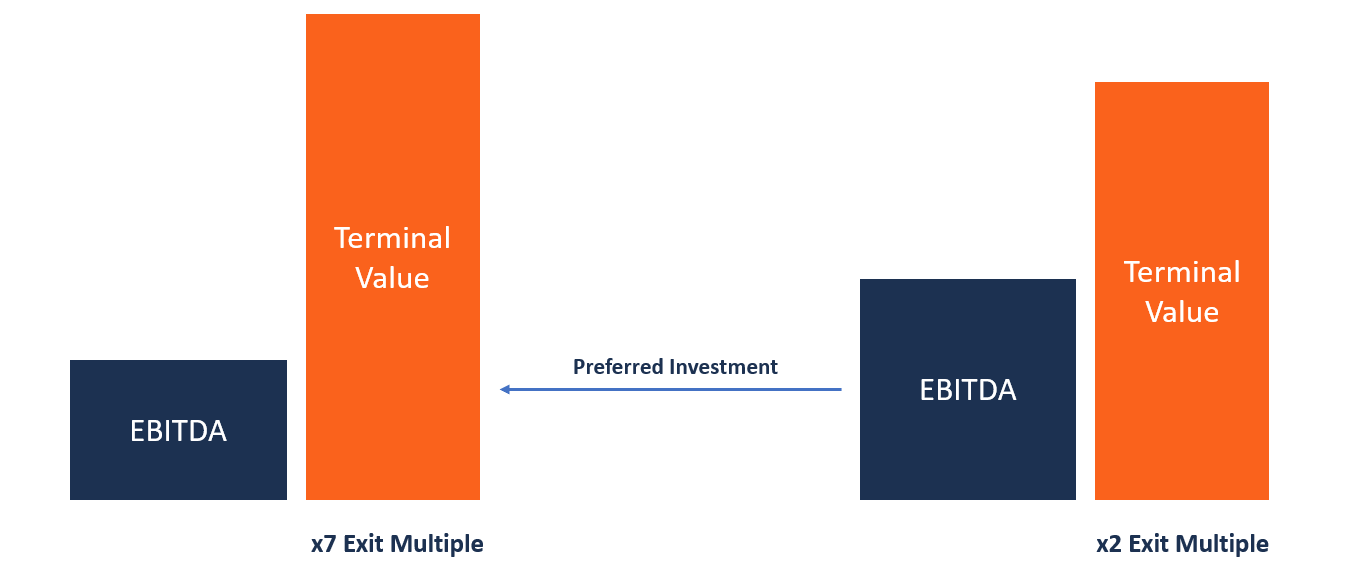

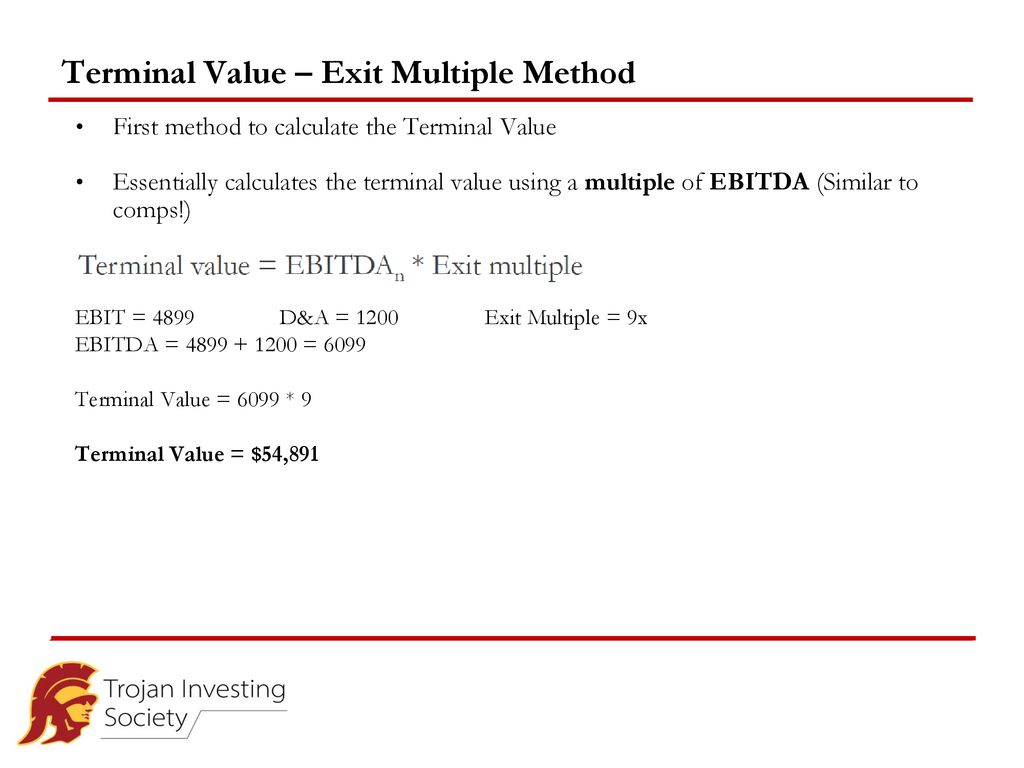

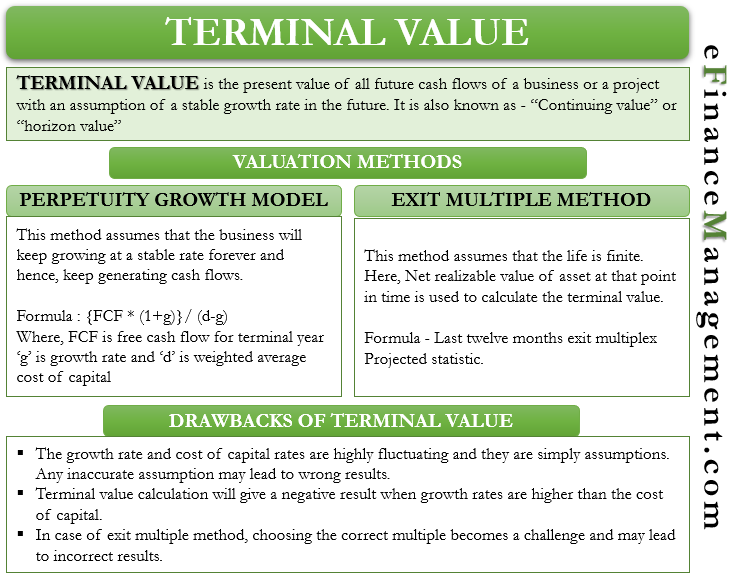

Dheeraj on X: "Terminal Value | Perpetuity Growth & Exit Multiple Method https://t.co/SJwn3NsJaQ #TerminalValue https://t.co/0RL1z24MTO" / X

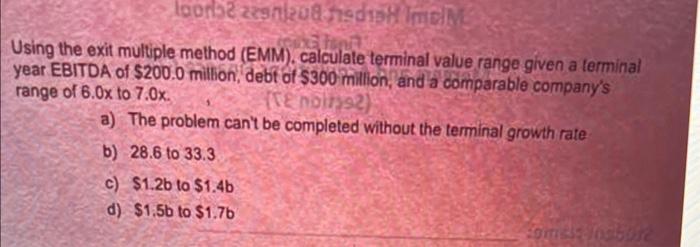

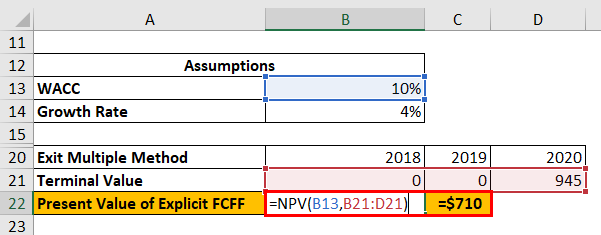

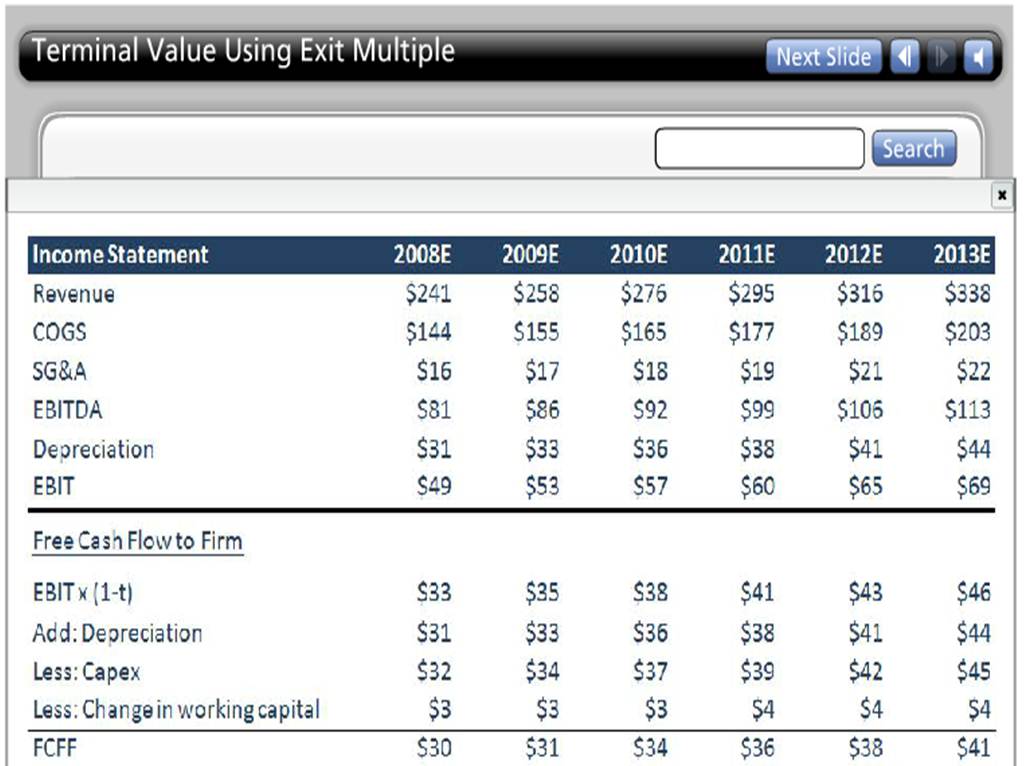

SOLVED: 2021 2022 2023 2024 2025 EBIT 2.9 4.1 4.8 5.8 6.2 Depreciation 1.1 1.2 1.5 1.6 1.9 Tax 0.87 1.23 1.44 1.74 1.86 Net Capital Spending 0.5 0.8 1 1.2 2

:max_bytes(150000):strip_icc()/terminalvalue-Final-12edef62cff74d4c9e2e62c82ac1b606.jpg)